Malaysia E-Invoice

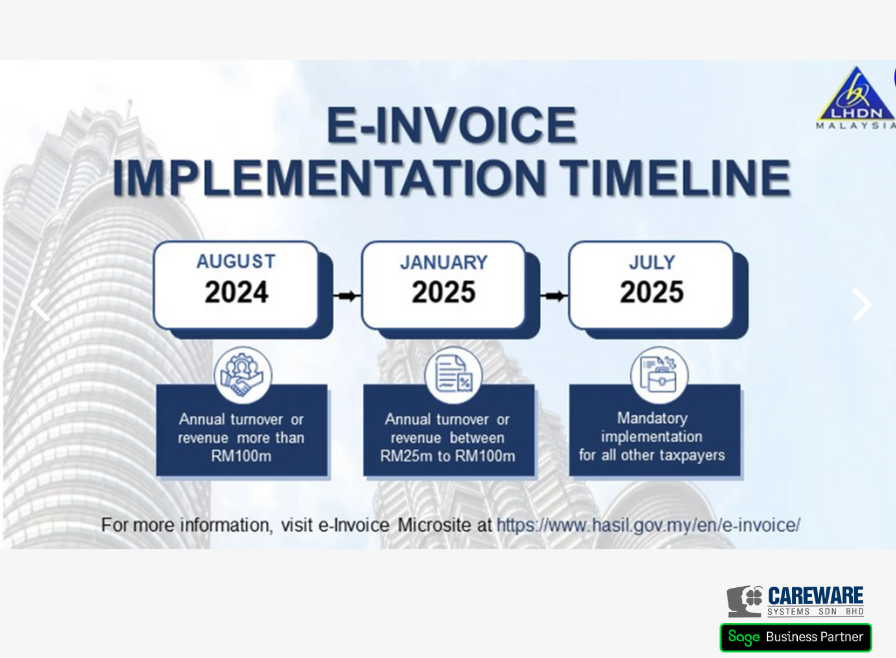

These regulations by the Inland Revenue Board of Malaysia reflect the government’s commitment to digital transformation and enhancing efficiency in commercial activities. By mandating e-invoicing for businesses above certain revenue thresholds, Malaysia aims to realize the benefits of electronic invoicing, such as cost savings, improved accuracy, and streamlined processes.

Businesses affected by these regulations should begin preparations for implementing e-invoicing to meet the specified deadlines and ensure compliance with the requirements set forth by the authorities. This may involve investing in e-invoicing solutions, training staff, and updating internal processes to support electronic invoicing.

Overall, the phased implementation of e-invoicing in Malaysia represents a significant step towards modernizing business practices and aligning with global trends in digital commerce and financial management.

E-invoicing, or electronic invoicing, offers several benefits for businesses and organizations: